| Fairness |

Trustworthiness |

Kindness |

| Patience |

Gentleness |

Knowledge |

| Discipline |

Compassion |

Integrity |

The below article was written by Charles Rotblut, CFA, the American Association of Individual Investors'

Journal Editor. It is a call to all owners of stock to become aware of the outrageous compensation being paid to company

CEOs with no regard for the quality of their leadership or resulting return for investors in their companies. The top

1% continues to stifle our economy by personally claiming more than their share of the wealth being created by their companies.

The last figures I saw indicated the top 1% is receiving over 50% of the new wealth being created.

There is no shortage of capital in the USA as interest rates are and have been at all time lows. So, contrary to frequently

heard musing, the money is not needed for investing in new businesses. They can't spend all the money they make, so goods

and services aren't purchased as they would be if the money went to workers or stockholders.

Learn about the compensation of CEOs of the companies whose stock you own and vote accordingly."

High CEO Pay Means Disappointing Stock Returns

Thursday, July 28, 2016

“Companies that awarded their Chief Executive Officers (CEOs) higher equity incentives had below-median

returns.” This is how MSCI started a report on CEO compensation.

The idea of awarding CEOs equity in the companies they oversee was originally pitched as a way to align the interests of corporate

executives with those of shareholders. If the stock fared well, shareholders would benefit and CEOs would be rewarded for

driving up the stock price. Yet this has not been the case for many companies.

“If the total summary pay figures were effective in incentivizing superior future performance, we would expect to see

a strong correlation between higher pay figures and 10-year TSRs (total shareholder returns). However, we found very little

statistical evidence to support this; in fact, we found a small but consistently negative relationship, a possible indicator

that superior performance may have been linked to lower rather than higher pay awards,” wrote Ric Marshall and Linda-Eling

Lee of MSCI’s ESG (environmental, social and governance) research team.

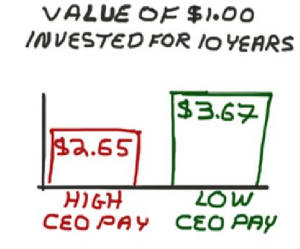

During the period of 2005 through 2014, shareholders of companies with the lowest CEO pay realized 39% greater total returns

than shareholders of companies with the highest CEO pay. Put another way, investing $1.00 in the companies whose CEO compensation

ranked in the bottom 20% would have grown into $3.67. Investing the same $1.00 in the highest CEO-paying quintile of companies

would have only turned your investment into just under $2.65. When Marshall and Lee analyzed companies by their sector allocation,

the same inverse relationship appeared: higher CEO pay meant lower shareholder returns.

Given this, it would seem logical that shareholders would use “Say on Pay” votes to express their displeasure.

The exact opposite has occurred, with approval rates exceeding 90% for many companies. Setting aside issues about the proportion

of shareholders either not voting their shares or simply going along with the board of directors’ recommendations, there

is a hurdle to figuring out exactly how much the CEOs are getting paid. An investor looking at a proxy filing (SEC filing

DEF 14A) has to combine data from several different tables to calculate the CEO’s compensation.

Even compiling the data mandated to be disclosed isn’t enough to grasp the full picture. Marshall and Lee point to the

lack of cumulative realized pay—what the CEOs actual take home from stock and option grants—in SEC filings. They

also point out that shareholders don’t know how much compensation CEOs have realized over the course of their tenure

or how the cumulative compensation compares to stock performance.

Making matters worse is that the compensation committees often base CEO compensation on what other companies are paying their

executives. It’s akin to what’s happened in the world of sports, where salaries have soared as athletes use their

peers’ compensation to negotiate better deals. These contracts are often announced by the media with no analysis about

how much extra ticket sales, television viewership or merchandise sales the high-priced player will bring. Texas Rangers fans

have found this out with Prince Fielder, who is due $96 million through the 2020 season according to CBS Sports. The first

baseman is incurring his second injury-shortened season in three years and questions are now being legitimately being raised

about how well he’ll play when he returns in 2017.

Ironically, the same day MSCI released its report, The Wall Street Journal published an article discussing how companies are

trying to woo individual investors to vote. Railroad operator CSX (CSX) is going as far as to plant a tree for every shareholder

who votes. The reason? According to the article, individual investors overwhelmingly side with the company’s management

and can be a helpful swing vote in close corporate elections.

Companies should not count on our support. We shareholders are owners. It's up to us to look out for financial interests,

which can mean disagreeing with the board of directors’ proxy recommendations as well as voting against Say on Pay proposals.

|