|

We use the KISS system

For those of you who don't know, KISS means "Keep it simple, stupid".

We like to keep it simple. When we receive a BUY signal, we purchase investments that represent broad segments of the total market. When we receive a SELL signal, we sell these shares.

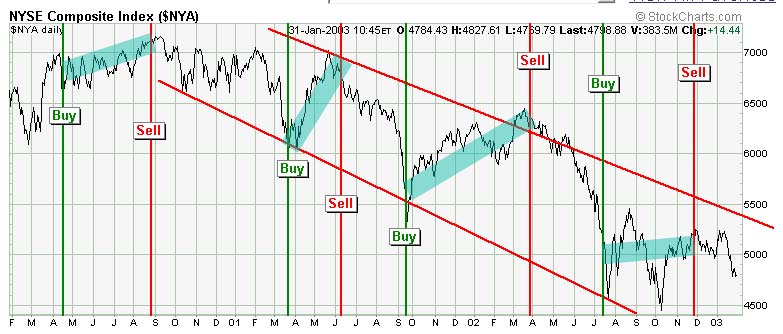

You can see in the following chart what would have happened if we had been using this approach since 2000 while the NYSE Composite Index was dropping in value. Even though the overall trend of the market was down, if we traded a total market Exchange Traded Fund (ETF) such as VTI we would have been able to achieve profitable trades four times during this period.

You will notice that we would have had to get in the market close to the BUY signal and get out of the market close to the SELL signal to avoid the possibility of paying too high a price getting in and receiving too low a price geting out.

You'll also notice the average number of signals during this period was three per year. Using this system requires patience but the results are worth it.

|

| Chart courtesy of StockCharts.com |

|